salt tax deduction california

Now SALT deductions are capped at 10000 the same for single and married taxpayers. Year-End Tax Deal Could Significantly Boost Trumps Corporate Tax Cuts At the time it was enacted the 2017 tax law was projected to cost 15 trillion over a decade.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes.

. California Approves Workaround to SALT Deduction Cap By Tim Johnson CPA July 16 2021 Reading time. The SALT deduction allows taxpayers to deduct state and local taxes from their federal taxable income and was written into the federal tax code since the inception of the. Your Complete Guide Certain businesses can avoid the California SALT deduction cap but you must act quickly to be.

California Governor Gavin Newsom signed Assembly Bill 150 on July 16 2021 incorporating a state and local tax SALT workaround through an elective 93 tax for pass. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

1 The cap on SALT deductions applies for tax. With AB 150 Fun and Games Partnership directly pays tax to California of 93 each for 37200 each. On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass.

The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments. The Tax Cuts and Jobs Act. Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately.

California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and. Lets break down how it impacts taxpayers who. 52 rows As of 2019 the maximum SALT deduction is 10000.

The TCJA added in IRC Section 164b6 effectively placing a 10000 cap on taxpayers federal itemized SALT deductions. This limit applies to single filers joint filers and heads of household. Call 707 382-3905 California SALT Deduction Workaround.

California does not allow a deduction of. This tax is deductible for Federal tax purposes so they now only pay Federal tax on. Polling data suggested the 10000 SALT deduction along with the 750000 cap on mortgage interest deduction.

Then in December 2017 The Tax Cuts and. Californians could be voting their pocketbooks on this issue. Changes to the State and Local Tax SALT Deduction - Explained The new tax law caps the state and local tax deduction at 10000.

While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for. The 10000 SALT deduction limitation includes all state local real and personal property taxes. For many Californians and other taxpayers located in high-tax states like New York and New.

Effective for tax years 2021-2025 the Small Business Relief Act provisions of AB. In New York the deduction. To offset this limitation the legislature of California and 26 other states sought.

150 allow passthrough entities including partnerships limited partnerships LLCs and S Corporations. 4 minutes California business owners have been given a. This deduction is a below-the-line tax.

The deduction has a cap of 5000 if your.

California Proposes State And Local Tax Cap Workaround

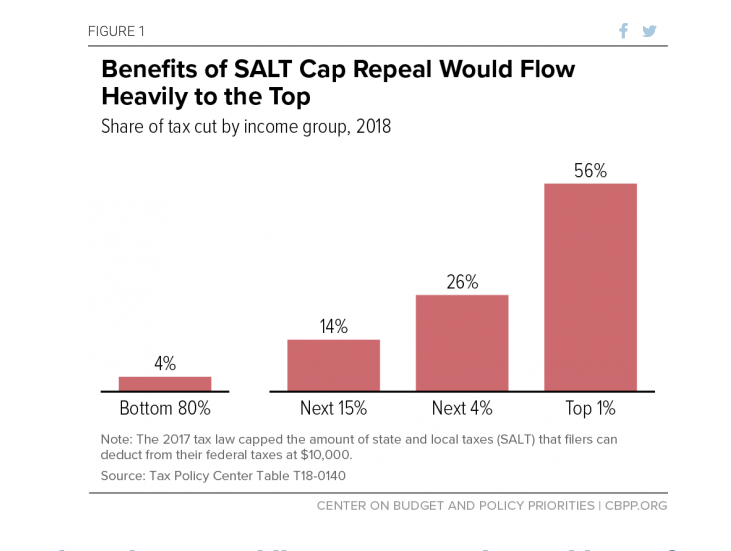

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

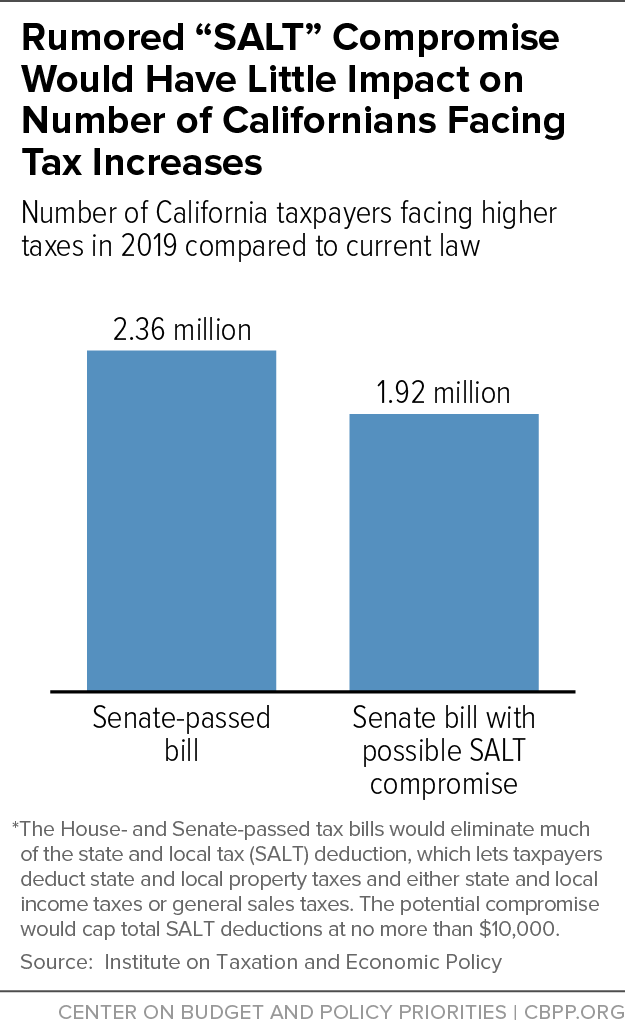

Even With Potential Salt Compromises Senate Bill Forces California And New York To Shoulder A Larger Share Of Federal Taxes While Texas Florida And Other States Will Pay Less Itep

Strategies To Preserve Salt Deductions For High Income Taxpayers

New California Law Offers Workaround For State And Local Tax Deductions Llme

California And Illinois Consider Way Around Federal Cap On Salt Deductions For Individuals Armanino

California Passes Salt Deduction Workaround With Limits Weaver

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

The Federal Government Really Jacked Us How Trump S Tax Cuts Are Working Out For Californians Calmatters

Skelton It S Time To Lift The Cap On Salt Deductions Los Angeles Times

California S Pass Through Entity Tax Election Providing Relief From The Salt Deduction Cap

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Update California House Members Appear To Be Settling For Bad Salt Compromise Center On Budget And Policy Priorities

The Deduction For State And Local Taxes The New York Times

The Price We Pay For Capping The Salt Deduction Tax Policy Center

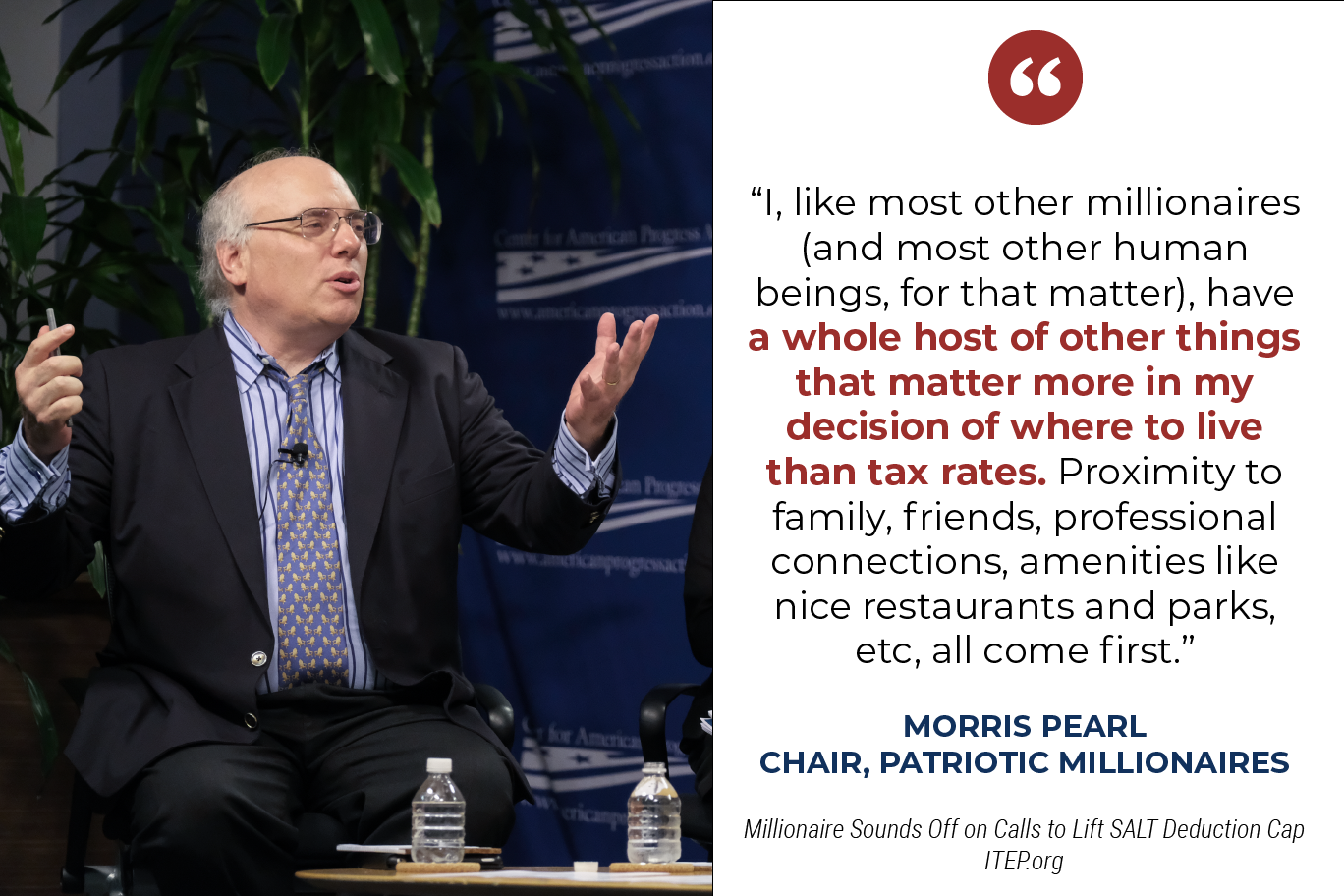

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland